How To Find Agi For Last Year

2020 Adjusted Gross Income or Prior AGI

Quick tips for entering your 2020 AGI:

- If you filed a 2020 Return using the non-filers tool in 2021 for the advance Child Tax Credit or 2020 Recovery Rebate Credit, enter "1" for $1 as your prior-twelvemonth AGI verification.

- If you did not file a 2020 Return or you are affected by the IRS verification processing delays as described beneath, enter "0" for $0 as your prior-year AGI verification.

- If you lot filed or e-filed a 2020 Return in 2021, enter your 2020 AGI found on Form 1040 or 1040-SR, Line eleven.

- Regardless of your filing method, if y'all cannot retrieve this effigy, create or view your IRS Account and locate your 2020 transcript.

Here, y'all will find instructions on how to obtain and/or correct your 2020 AGI afterward you accept e-Filed a tax return. Meet step-past-step instructions to obtain your AGI and view more details on IRS 2021 and 2022 processing delays.

2020 AGI Instructions, Tips

2020 AGI Update: The IRS announced on January 7, 2022 that nearly 6 million returns and 2.three million taxation amendments had not been candy.1) This does non mean your 2020 Return was not accustomed. However, every bit a result, your actual 2020 AGI might non match the 1 the IRS has on record. For example, even though you might take filed a 2020 Return, the IRS might not have entered this into their system, maybe due to COVID-19, thus you might have to enter 0 - the number goose egg - as your 2020 AGI on your 2021 Return in order to get it accepted by the IRS. This is because you need to match what the IRS has in their system, regardless of whether this is right or wrong, in social club to get your return accepted. At the aforementioned time, if you enter 0 and the IRS does have the actual 2020 AGI dollar amount on record, your return would get rejected as a mismatch.

2020 AGI rejection issue | How to correct your AGI for eFile.com users.

In lodge to east-file your 2021 return in 2022, the IRS requires you to provide the Adjusted Gross Income (AGI) from your previous year's return as a form of identification for e-filing - it is not needed to postal service your return. An incorrect 2020 AGI on your 2021 Return will consequence in a tax return rejection by the IRS and/or state tax agency. It is easy to correct your AGI and resubmit your return if this happens. If you filed your 2020 Return on eFile.com, your 2020 AGI is ready for you when you prepare and eFile your 2021 Revenue enhancement Return. If you DID NOT ready and e-file your 2020 Tax Render on eFile.com, click here to get your 2020 Adjusted Gross Income if you practice not already accept it.

Important: If you lot collected unemployment benefits during 2020 and received a refund as a consequence of the Unemployment Bounty Exclusion (UCE), endeavor to e-file using your original, accepted 2020 AGI, non the adjusted AGI. This is for taxpayers who filed early in 2021 before the Unemployment Compensation Exclusion was signed into police.

Tip: Use eFile.com in 2022 when you lot fix and eFile your 2021 Return and your 2021 AGI will exist in your account in 2023 - sign upward here.

How to Obtain, Notice Your 2020 Tax Render AGI

Follow these detailed didactics how to obtain your 2020 AGI. Keep in listen, you can also obtain and utilize an IP-Pivot (Identity Protection - Personal Identification Number) as an alternative to your 2020 AGI during the tax return e-Filing procedure.

Here are iii means to locate your 2020 Adjusted Gross Income, AGI:

1) If you eastward-Filed your 2020 Taxation Return on eFile.com, sign into your eFile.com account and view and/or download your PDF tax return file from the My Business relationship page. Find your prior-year AGI on Line xi of your 2020 Form 1040.

ii) If you filed elsewhere and you practice take a copy of your 2020 Tax Render, identify the exact grade and line number for your AGI. This will be on Line 11 of IRS Form 1040, 1040-SR, and 1040-NR. Note: Grade 1040-NR cannot be e-filed anywhere - see information on the various 1040 forms.

three) If you did Not eFile your 2020 Tax Return on eFile.com and you don't have a copy of your 2020 1040 Form, y'all can become a costless transcript now from the IRS online. See detailed instructions on how to obtain an IRS transcript or tax return copy.

Go Render Transcript

This is a free service provide past the IRS and your prior year AGI will be on the transcript listed as Adapted GROSS INCOME. You lot can then enter it on eFile.com during the checkout and e-file procedure for your 2021 Taxation Return. Y'all can also call the automated IRS Transcript Order Line at 1-800-908-9946 if you tin not get your transcript online.

You can as well formally request a copy of your render from the IRS if you did non use eFile.com for the revenue enhancement year in question equally we store returns for eFile.com users for 7 years.

Important notes:

- If you e-filed (or filed) your 2020 Tax Return subsequently in 2021 (after September), and so the IRS about likely will NOT take an updated 2020 AGI for you in their systems. Therefore, y'all will need to enter "0" as your prior-year AGI when you e-file your 2021 Tax Render (meet instructions below for more details).

- If y'all filed a taxation amendment for your 2020 Return and your Adapted Gross Income inverse equally a result, you will need to employ the inverse AGI amount from your amendment instead of the one on your originally filed 2020 Tax Return. If, nonetheless, this is rejected, attempt to due east-file again using the original AGI.

Once your 2021 Tax Return is accepted by the IRS via eFile.com in 2022, nosotros advise returning the post-obit twelvemonth to fix and eFile your 2022 Tax Return equally your 2021 AGI volition be in your eFile.com account and you won't accept to search for it.

IP Pin in 2022: In 2022, taxpayers can obtain their own Identity Protection Pin or IP Pivot. Meet more than details on the IRS issued IP-PIN.

How to Enter Your 2020 Adjusted Gross Income on eFile.com

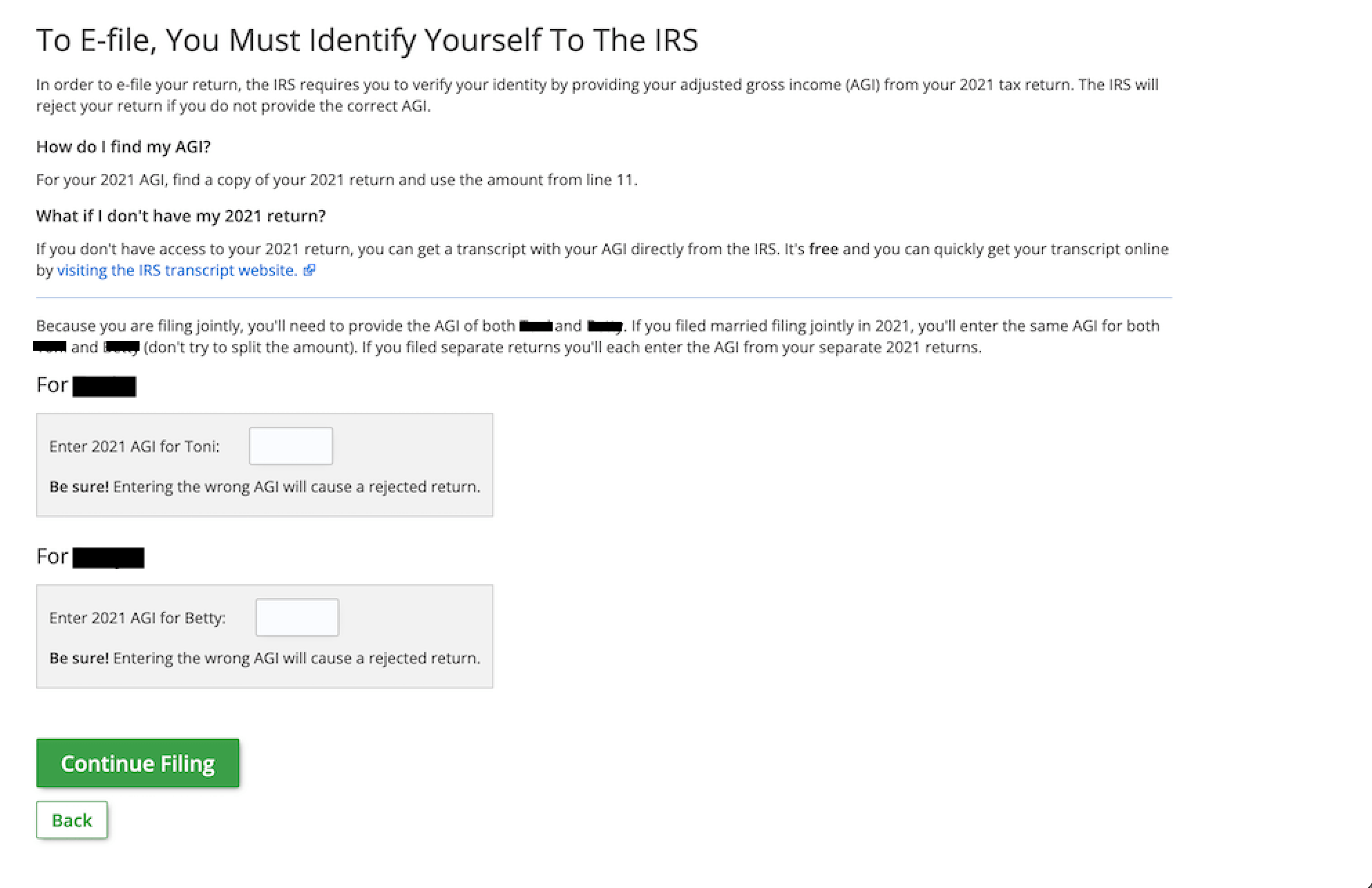

Note: The paradigm below is for informational purposes only and is not interactive. If you are not filing your tax return with the Married Filing Jointly filing status, you lot will only see ane AGI box for yourself.

Once y'all take your 2020 AGI, sign into your tax return and follow the instructions below:

1.) Click File on the left menu box.

2.) You volition see your refund/residuum due amount. ClickContinue.

3.) Your return will be completed and when it is finished (after going through the checkout process), click Continue. Click View Render if you want to view/impress your forms. This is highly recommended so that you can run into the final return that is to be submitted to the IRS and to make sure that yous oasis't entered anything incorrectly.

four.) Next is the E-filing Your Return screen. Make sure y'all select the render(due south) you want to eFile and click Go on.

5.) Select if you lot want to take your tax refund mailed or deposited to your bank account and click Go on. We generally recommend directly deposit for your tax refund.

half dozen.) You will be asked if you lot (and your spouse, if your filing status is Married Filing Jointly) filed a tax return last year. Select Yes and click Continue. If you lot did non eastward-file or file a tax return last year, answer No. We will automatically enter 0 equally the number to verify your identity with the IRS (0 is your AGI for 2020 if you did non or take not yet filed your 2020 Return, you did not take any income that year, or the IRS does not have record of your 2020 AGI for whatsoever reason).

7.) If you lot select Aye for filing a tax render concluding year, the next screen is: To E-file, You Must Place Yourself to the IRS. Enter your AGI in the box next to the Enter last year'southward AGI line. If you are filing a joint taxation return, enter the same AGI for you and your spouse (if you or your spouse did not file or due east-file a tax return last yr, enter 0 in the appropriate AGI field). Once you take entered your AGI(due south), click Continue. (Notation: the image below is for informational purposes just and is non interactive. If you are not filing a Married Filing Joint revenue enhancement return, you lot will only see one AGI box for yourself). If you cannot locate your prior year AGI, you will need to print your return, sign it, and mail it to the IRS so it can exist filed. There is no need for IRS AGI acceptance when mailing in your return since the AGI is not needed to establish your identity on a mailed return.

viii.) Identity Protection PIN (IP PIN) - You are asked if you lot (and/or your spouse) received an Identity Protection PIN from the IRS. This vi-digit PIN is either assigned by the IRS to a victim of identity theft or is requested by a taxpayer and sent to yous in a letter from the IRS via certified mail. Click Yes if you lot received one and enter the IP Pin on the next screen; otherwise, click No. You tin can likewise obtain a new IP-Pivot here.

9.) Personal Identification Electronic Signature Pivot - Y'all are asked to create whatsoever v-digit PIN to electronically sign your render. This can be any five numbers you cull except 12345 or still digits, such equally 55555.

ten.) Click Proceed and, on the next screen, bank check the I'm not a robot box and click E- file to submit your render.

Yous are done! Y'all will receive an email confirming that your render has been accepted past the IRS. Y'all should hear back from the IRS in 24-48 hours concerning the status of your return. If you lot practice non receive an email, make sure you do not have a spam filter blocking it. If your return is rejected by the IRS, don't worry as you lot can sign back into your account and see the reason why the IRS rejected it (on the My Return screen) with stride-past-footstep instructions to correct and resubmit your return.

Important: You can eFile your revenue enhancement return as many times every bit you lot need to at no extra accuse. Just right your AGI and eFile or re-submit your revenue enhancement return once more.

To become more than assistance entering your prior twelvemonth AGI, contact an eFile.com Taxpert to receive personal assist on correcting and re-filing your tax return so the IRS accepts it.

What About the PIN?

Many PINs are beingness referred to when e-fling your render. To help with whatever defoliation you might accept, here is an explanation of them all:

ane.) IP PIN - This stands for Identity Protection Personal Identification Pivot and is the IRS assigned (or taxpayer requested) half dozen digit PIN to enter when y'all east-file your render. You will Only need to enter this Pivot if you have received it from the IRS. The IRS volition generally send your IP Pin to you in a letter, but you tin can obtain your IP Pin online via the IRS website.

2.) Electronic Signature Pin - This is a 5 digit number that tin can be randomly selected by yous when you lot e-file your return. Yous practice Non need to use the same signature Pivot as you used final year. It can be any v numbers you choose except 12345 or even so digits, such equally 55555. On eFile.com, you lot enter this Pivot at the final stride of the bank check out and eastward-file process.

3.) Electronic Filing Pivot, or eFile PIN - This PIN is no longer needed when you due east-file your return as the IRS stopped using this PIN with 2018 Returns. You lot now need your Adjusted Gross Income (AGI) from your previous twelvemonth's tax render when you east-file your current year return.

What is a MAGI?

MAGI stands for the Modified Adapted Gross Income. It is also referred to as the household's Adapted Gross Income with certain tax deductions added to your income and whatsoever taxation-exempt interest income. The MAGI is used to determine if a taxpayer qualifies for the following tax benefits:

- Roth IRA contributions if your MAGI is under the IRS specified limits.

- Deduct your traditional IRA contributions if y'all and/or your spouse has a piece of work based retirement plan. Yous can contribute to a traditional IRA no thing how much money yous earn, but you lot can't deduct those contributions when you file your taxation render if your MAGI exceeds set limits.

- If a taxpayer is eligible for the Premium Revenue enhancement Credit which lowers your health insurance premiums for wellness plans bought via the Wellness Insurance Marketplace.

- It establishes eligibility for income-based Medicaid.

ane) Source: Means and Means Committee Report February 2021.

ii) Source: IRS Report Jan 7, 2022.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.

Source: https://www.efile.com/adjusted-gross-income-or-agi/

Posted by: hancockrouressedly.blogspot.com

0 Response to "How To Find Agi For Last Year"

Post a Comment